In today’s digital age, financial inclusion is paramount for individuals across the globe. Whether you’re a local resident or an expatriate seeking secure financial services, opening a bank account is often the first step towards managing your finances efficiently. Mukuru Account stands as a beacon of financial empowerment, offering accessible banking solutions tailored to diverse communities. In this comprehensive guide, we’ll walk you through the straightforward process of opening a Mukuru account.

How to Open a Mukuru Bank Account

Mukuru Bank is a leading financial institution dedicated to providing accessible banking services to individuals and communities, particularly in emerging markets. With a commitment to exclusivity and innovation, Mukuru Bank offers a range of services, including savings accounts, money transfers, and more.

Why Choose Mukuru?

Before delving into the account opening process, it’s essential to understand the advantages of choosing Mukuru Bank:

- Accessibility: Mukuru Bank prioritizes accessibility, ensuring that individuals from all walks of life can access essential banking services conveniently.

- Affordability: With transparent fee structures and competitive exchange rates, Mukuru Bank ensures that its services remain affordable for its customers.

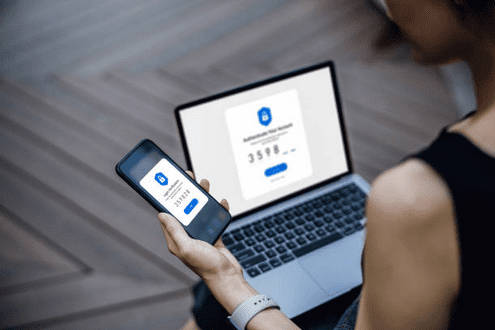

- Security: Mukuru Bank employs robust security measures to safeguard your funds and personal information, providing peace of mind in an increasingly digital world.

- Convenience: Through innovative digital platforms and a network of partners, Mukuru Bank offers convenient banking solutions tailored to your needs.

Step-by-Step Guide

Opening a Mukuru Bank account is a straightforward process that can be completed in a few simple steps:

- Visit the Mukuru Bank Website: Begin by visiting the official Mukuru Bank website (www.mukurubank.com) to initiate the account opening process.

- Select ‘Open an Account’: Navigate to the ‘Open an Account’ section on the website, where you’ll find detailed information about the account types offered by Mukuru Bank.

- Choose Your Account Type: Mukuru Bank offers various account types to suit your needs, including savings accounts, current accounts, and more. Select the account type that aligns with your requirements.

- Provide Personal Information: Fill out the online application form with your personal information, including your full name, date of birth, contact details, and residential address. Ensure that all information provided is accurate and up-to-date.

- Verify Your Identity: As part of the account opening process, you may be required to verify your identity through documentary evidence, such as a valid passport, national ID card, or driver’s license. Follow the instructions provided to complete the verification process securely.

- Agree to Terms and Conditions: Review and agree to the terms and conditions outlined by Mukuru Bank before proceeding with your account opening.

- Submit Your Application: Once you’ve completed the necessary steps, submit your application electronically through the Mukuru Bank website.

- Confirmation and Activation: Upon successful submission, you’ll receive confirmation of your account opening request. Follow any additional instructions provided to activate your account and gain access to Mukuru Bank’s suite of banking services.

Frequently Asked Questions About How to Open a Mukuru Bank Account

1. Who can open an account?

Mukuru Bank welcomes individuals from all walks of life to open an account. Whether you’re a local resident or an expatriate, Mukuru Bank strives to provide inclusive banking solutions to meet your needs.

2. What documents are required to open an account?

The documents required may vary depending on your location and the specific account type you’re applying for. Generally, you’ll need to provide identification documents such as a valid passport, national ID card, or driver’s license, as well as proof of address.

3. Can I open an account online?

Yes, Mukuru Bank offers the convenience of opening an account online through its official website. Simply visit www.mukurubank.com, navigate to the ‘Open an Account’ section, and follow the instructions to complete the online application.

4. How long does it take to open a Mukuru Bank account?

The account opening process with Mukuru Bank is typically swift, allowing you to complete the necessary steps and gain access to your account within a short timeframe. However, processing times may vary depending on factors such as verification requirements and the volume of applications received.

5. Is there a minimum deposit required to open a Mukuru Bank account?

Mukuru Bank strives to keep its services accessible to all individuals, including those with limited financial resources. As such, there may be minimal or no deposit requirements for certain account types. However, it’s advisable to check the specific account terms and conditions for details regarding minimum deposit requirements.

6. Can I open multiple accounts with Mukuru Bank?

Yes, Mukuru Bank allows individuals to open multiple accounts, provided they meet the eligibility criteria and comply with the bank’s policies and regulations.

7. Are there any fees associated with opening a Mukuru Bank account?

Mukuru Bank aims to provide transparent and affordable banking solutions to its customers. While there may be nominal fees associated with certain account services or transactions, such as account maintenance fees or transaction charges, these are typically disclosed upfront, allowing you to make informed decisions.

8. How can I contact customer support for assistance with opening a Mukuru Bank account?

If you require assistance or have any questions regarding the account opening process, you can reach out to Mukuru Bank’s customer support team through various channels, including phone, email, or live chat support available on the official website.

Conclusion

Opening a Mukuru Bank account is a simple and convenient process that empowers individuals with access to essential financial services. By prioritizing accessibility, affordability, security, and convenience, Mukuru Bank remains committed to serving diverse communities and fostering financial inclusion worldwide. Whether you’re a local resident or an expatriate, Mukuru Bank stands ready to meet your banking needs and help you achieve your financial goals.

Leave a Reply